(CBAM), also known as Carbon Border Tax or Carbon Border Tax, is a tax levied by the EU on the carbon emissions of some imported goods. This mechanism requires that high-carbon products imported to or exported from the EU pay corresponding taxes and fees or refund corresponding carbon emission quotas.

The industries levied by the “carbon tariff” cover steel, cement, aluminum, fertilizers, electricity and hydrogen, mainly targeting direct emissions in the production process and indirect emissions in the three major categories of cement, electricity and fertilizers (i.e. during the production process Carbon emissions from the use of purchased electricity, steam, heat or cooling) and a small amount of downstream products.

1. What is the “EU Carbon Border Regulation Mechanism”?(Wedge Bolts For Concrete)

The Carbon Border Adjustment Mechanism (CBAM) is the supporting legislation of the EU Emissions Trading System (ETS). The ETS requires EU manufacturers of covered products to purchase carbon emission certificates from the government based on the carbon emissions produced during the production process. CBAM requires importers of covered products to purchase carbon emission certificates from the EU. In fact, it requires non-EU manufacturers that export covered products to the EU to pay the equivalent carbon emission costs as manufacturers within the EU.

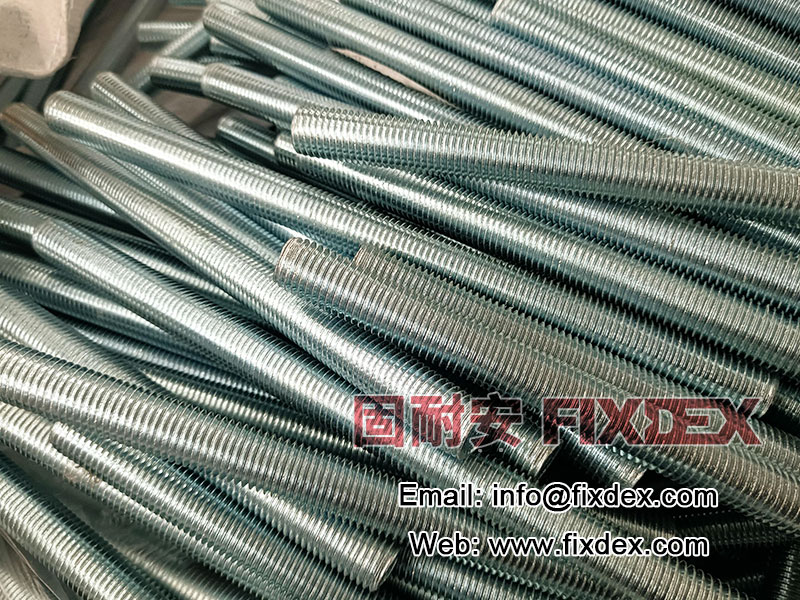

2. When will CBAM (Carbon Border Adjustment Mechanism) take effect and be implemented?(Threaded Rods And Studs)

The CBAM has entered into force on 17 May 2023 and will be implemented from 1 October 2023 in accordance with Article 36 of the CBAM.

The implementation of CBAM is divided into transitional and formal implementation phases. According to CBAM regulations, the CBAM transition period is from October 1, 2023 to December 31, 2025.

During the transition period, the main obligation of importers under CBAM is to submit quarterly reports to the CBAM authority. The report contents include:

(1) The quantity of each CBAM covered product imported in the quarter;

(2) Embodied carbon emissions calculated according to CBAM Annex 4;

(3) The carbon price that covered products should pay in their country of origin. Reports should be submitted no later than one month after the end of each quarter. Failure to submit reports on time will result in penalties.

3. What industries does CBAM cover?(Chemical Bolt)

After CBAM is officially implemented, it will apply to steel, cement, fertilizers, aluminum, electricity and hydrogen, as well as some precursors (such as ferromanganese, ferrochrome, ferronickel, kaolin and other kaolins, etc.) and some downstream products (such as steel screws and bolts) ). Annex 1 of the CBAM Act lists the names and customs codes of products covered by CBAM.

4. How to obtain CBAM’s authorized applicant qualification?(Drywall Anchor Screws)

The competent authority of the Member State in which the applicant is located is responsible for granting CBAM Authorized Notifier status. The status of an authorized CBAM filer shall be recognized in all EU Member States. Before approving a notifier’s application, the competent authorities shall carry out a consultation process through the CBAM registry, which shall involve the competent authorities of other EU countries and the European Commission.

5. Why do you need to obtain CBAM authorized declarer qualification?(Drop In Anchor For Concrete)

Unauthorized CBAM filers are prohibited from importing goods covered by CBAM.

If a person other than an authorized CBAM declarant imports goods into the EU in violation of CBAM, a fine shall be paid. The amount of the fine shall depend on the duration, severity, scope, intentionality and repetition of the conduct, as well as the relationship between the person punished and the competent CBAM authority. degree of cooperation. If the CBAM certificate is not handed over by the punished person, the penalty shall be 3-5 times the fine mentioned in paragraph 1 of the year of introduction of the goods.

6. How to purchase CBAM certificate?(Foundation Anchor Bolts)

The European Commission should establish a common central platform between the European Commission and the Member States for the sale of CBAM certificates. Member States should sell CBAM certificates to authorized CBAM filers.

The price of CBAM certificates shall be determined based on the average closing price of EU Emissions Trading Scheme allowances on the common auction platform each calendar week. Such average price shall be published by the European Commission on its website or by any other appropriate means on the first working day of the following calendar week and shall apply from the first working day of the following calendar week.

7. How to hand in the CBAM certificate?(Stainless Steel Bracket)

Authorized CBAM filers are required to surrender a certain number of CBAM certificates through the CBAM Registry before May 31 of each year. The number of certificates shall be consistent with the amount of embodied emissions declared in accordance with Article 6, paragraph 2 (c) and verified in accordance with Article 8.

Authorized CBAM filers are required to surrender a certain number of CBAM certificates through the CBAM Registry before May 31 of each year. The number of certificates shall be consistent with the amount of embodied emissions declared in accordance with Article 6, paragraph 2 (c) and verified in accordance with Article 8.

If the Commission finds that the number of CBAM certificates in the account does not meet the corresponding requirements, it shall notify the competent authority of the country where the authorized declarer is located. The competent authority shall notify the authorized declarer within one month and ensure that there is a sufficient number of CBAM certificates in his account. CBAM certificate.

8. What to do with the remaining CBAM certificates after they are surrendered?()

The remaining CBAM certificates after an authorized CBAM declarant surrenders the certificates as required shall be repurchased by the member state where the declarant is located. The European Commission should buy back CBAM certificates on behalf of the respective Member States.

Such repurchase quantity shall be limited to 1/3 of the total number of CBAM Certificates purchased by such authorized CBAM filer during the preceding calendar year. The repurchase price shall be the price at which the certificate was purchased by the authorized declarant.

9. Does the CBAM certificate have a validity period?(Hardware Pins)

The European Commission shall cancel by 1 July of each year any CBAM Certificate purchased in the year preceding the preceding calendar year that remains in an account in the CBAM Registry.

Post time: Dec-27-2023